utah state tax commission tap

Identity verification questions are based on information from your drivers license or state ID card and your Utah income tax returns for the previous one or two years if you had Utah tax returns for those years. Contact us by phone click on the Phone tab above for numbers.

You are being redirected to the TAP home page.

. Free Federal and State Tax Filing Sources. Register online-- TAP Tax Commission only-- OSBR multiple Utah agencies Note. The official site of the Division of Motor Vehicles DMV for the State of Utah a division of the Utah State Tax Commission.

Please do not submit duplicate registrations for your business using multiple methods. It does not contain all tax laws or rules. Sales Use Tax Workshop.

The report details current taxpayer andor property income results. There are many free filing options available even for taxpayers with higher incomes. It does not contain all tax laws or rules.

For security reasons TAP and other e-services are not available in most countries outside the United States. Salt Lake City UT 84134-3310. If you are not redirected to the TAP home page within 10 seconds please click the button below.

210 North 1950 West. Please contact us at 801-297-2200 or taxmasterutahgov for more information. If filing a paper return allow at least 90 days for your return to be processed.

Visit Utahgov opens in new window Services opens in new window Agencies opens in new window Search Utahgov opens in new window Skip to Main Content. Has already cleared your bank account contact Taxpayer Services at 801-297-7705. The letter will direct you to take the quiz on our secure website at taputahgov.

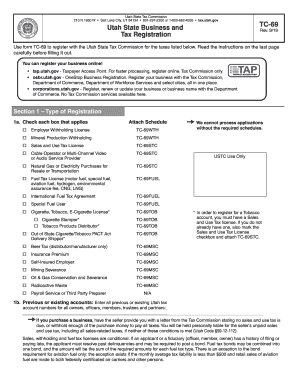

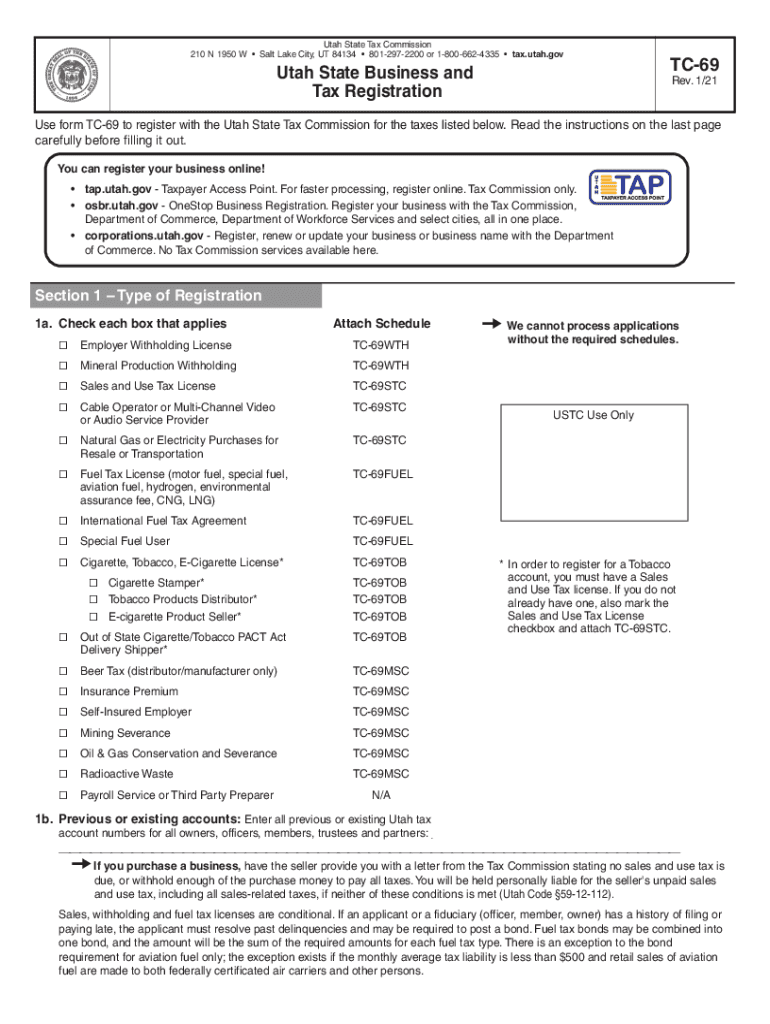

You will need to complete form TC-69 Utah State Business and Tax Registration. You can apply for an account on TAP using the Apply for Tax Account TC-69 link or file paper form TC-69. If you have not registered for a Sales and Use Tax account you must do so before filing.

How do I register for TAP. You have been successfully. All requested changes please be specific.

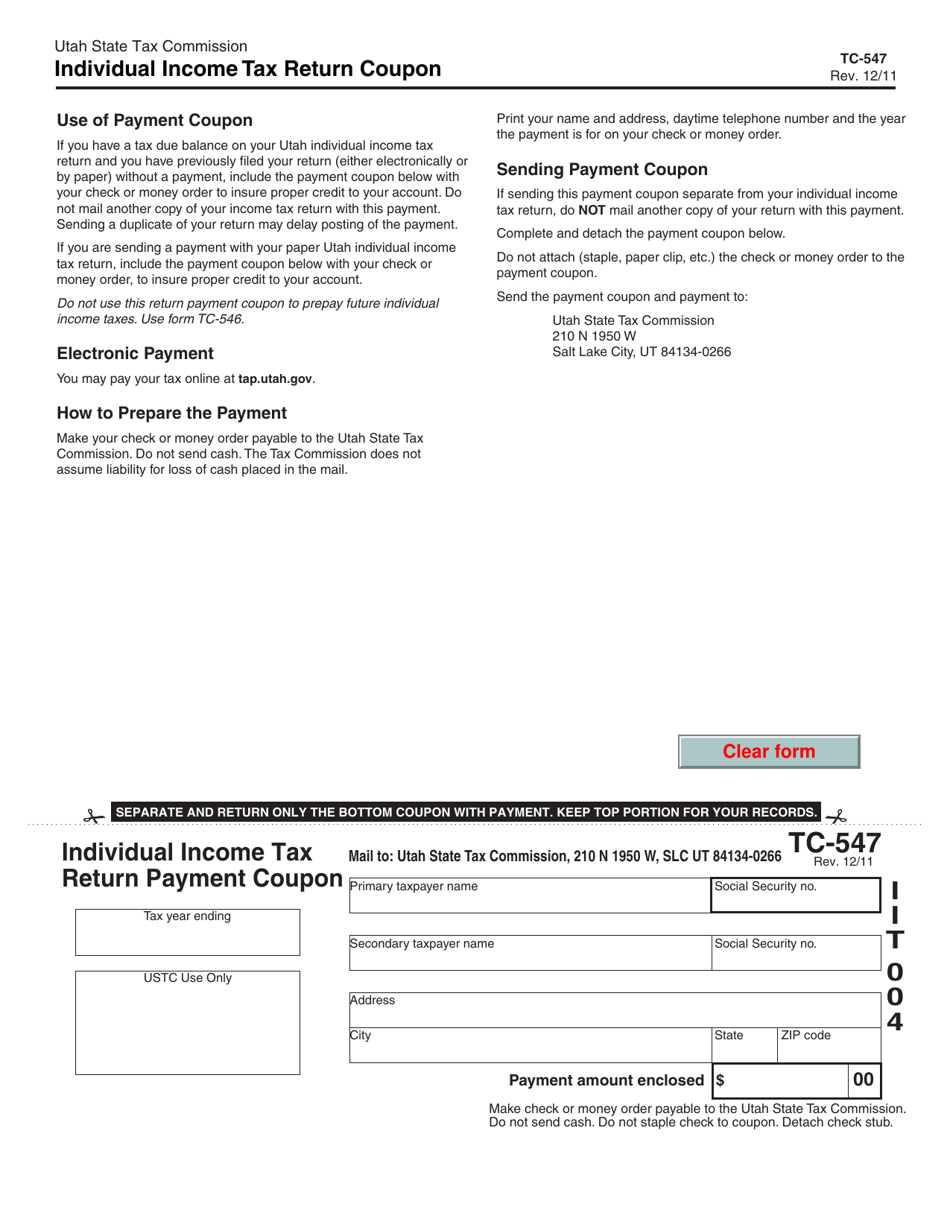

Mail your payment coupon and Utah return to. Save your work if you will be away from your computer. Utah Taxpayer Access Point TAP TAP.

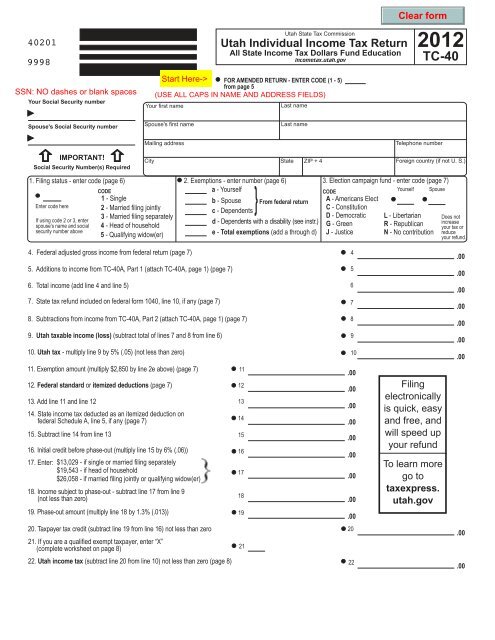

You can also change your address when you file your TC-40 Individual Income Tax return. Your session has expired. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah.

Include the TC-547 coupon with your payment. 261 rows Utah State Business and Tax Registration. In accordance with Utah Code Annotated 59-2-202 each centrally assessed Utility and Transportation taxpayer must annually file on or before March 1 a completed Annual Report and an Annual Return for Assessment with the Property Tax Division of the Utah State Tax Commission.

Due to increased workload the time to process new business registrations has increased significantly. Once you have your tax account you can use that account number and your PIN to create a TAP login. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. Click Here to Start Over.

TAP Taxpayer Access Point at taputahgov. The Utah State Tax Commissions free. Utah State Tax Commission 210 North 1950 West Salt Lake City UT 84134-0266.

Tax Instruction. Frequently asked questions about Taxpayer Access Point. Businesses and representatives accountants bookkeepers payroll professionals etc can use TAP to manage their Utah business tax accounts.

Utah State Tax Commission. It does not contain all tax laws or rules. For security reasons TAP and other e-services are not available in most countries outside the United States.

Individuals can use TAP to file current year Utah tax returns make payments request a payment agreement and request a waiver. I work for an out-of-state company submitting TC-941s TC-941Rs 1099s and W-2s for our Utah clients. Your online session will timeout after 60 minutes of inactivity.

Help manual for using Utahs Taxpayer Access Point TAP. Utah State Tax Commission SFG PO Box. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800.

Choose any of these for more information. Still shows Pending in TAP click your payment link and Withdraw. For security reasons TAP and other e-services are not available in most countries outside the United States.

Official information about taxes administered in the State of Utah by the Utah State Tax Commission. File electronically using Taxpayer Access Point at taputahgov. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

File your Sales and Use tax return at taputahgov. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. The Tax Commission is not liable for cash lost in the mail.

Still Waiting For Your State Income Tax Refund Something Is Probably Wrong

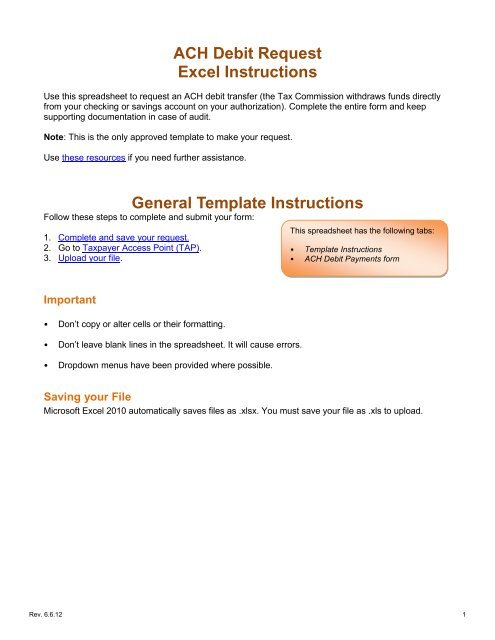

Ach Debit Request Excel Instructions Utah State Tax Commission

Utah Income Taxes Utah State Tax Commission

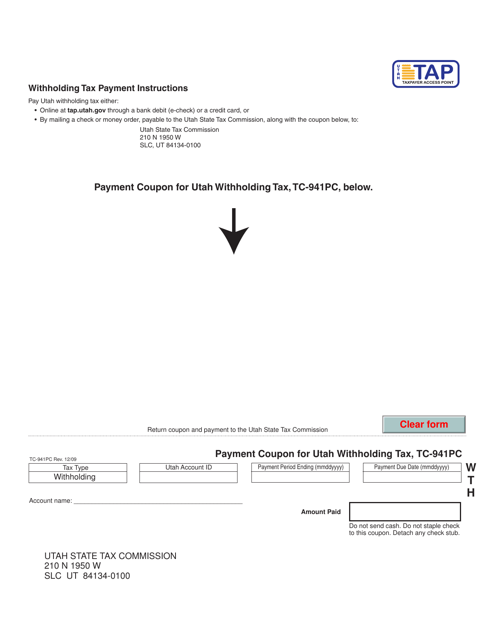

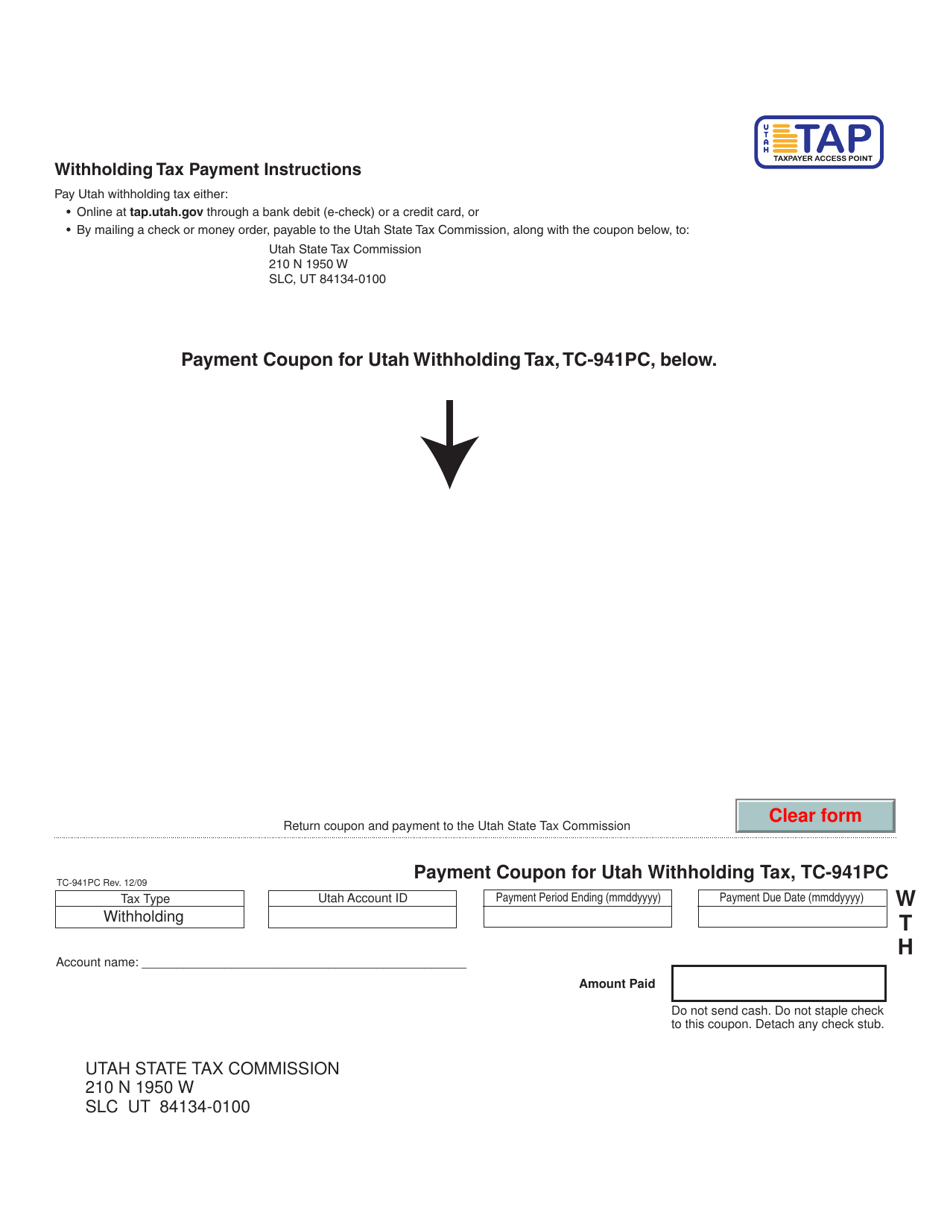

Form Tc 941pc Download Fillable Pdf Or Fill Online Payment Coupon For Utah Withholding Tax Utah Templateroller

Utah State Tax Commission Official Website

Itap Utah Fill Out And Sign Printable Pdf Template Signnow

Ut Tc 69 2021 2022 Fill Out Tax Template Online Us Legal Forms

Form Tc 62m Download Fillable Pdf Or Fill Online Sales And Use Tax Return For Multiple Places Of Business Utah Templateroller

Form Tc 547 Download Fillable Pdf Or Fill Online Individual Income Tax Return Payment Coupon Utah Templateroller

Form Tc 941pc Download Fillable Pdf Or Fill Online Payment Coupon For Utah Withholding Tax Utah Templateroller

Utah State Tax Commission Official Website

Form Tc 40 Utah State Tax Commission Utah Gov

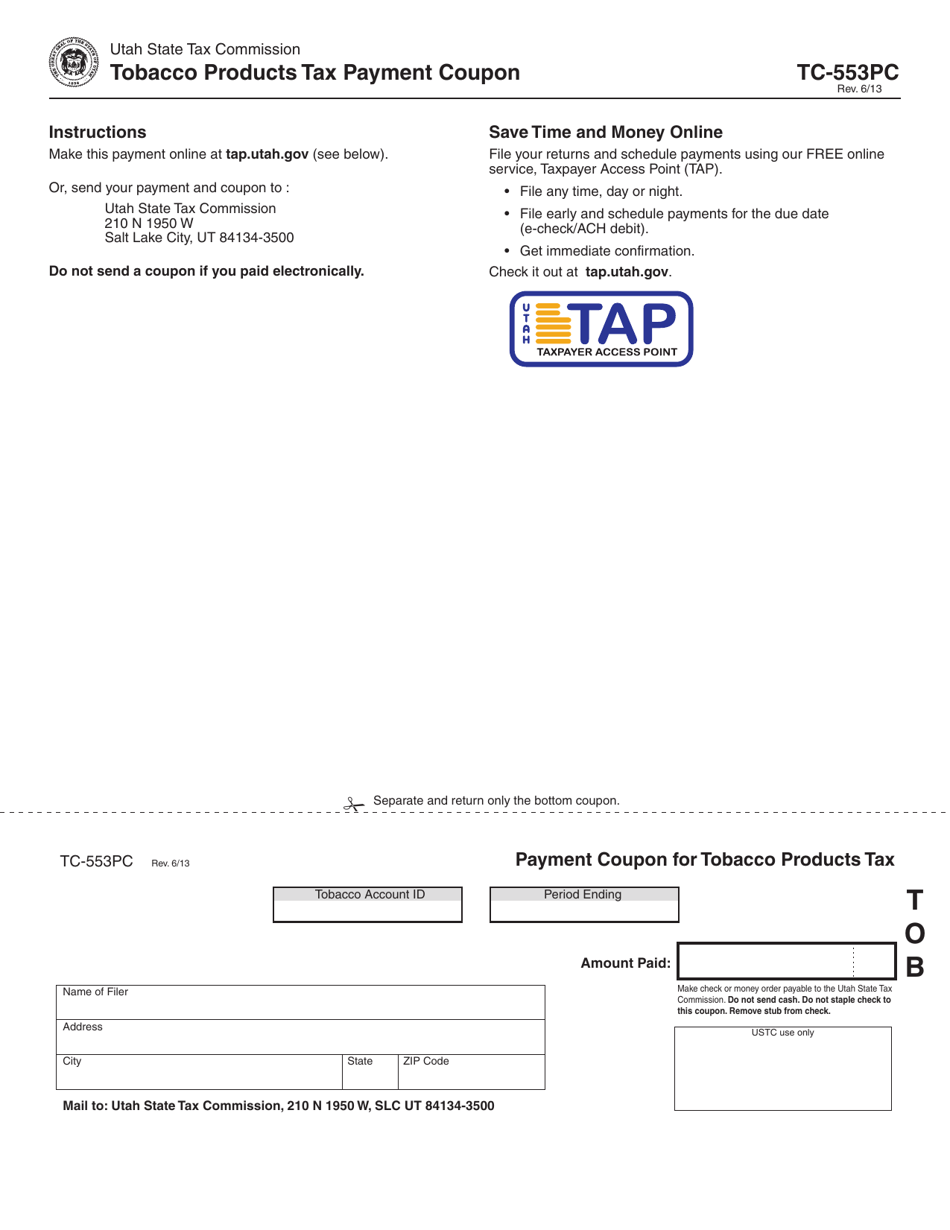

Form Tc 553pc Download Printable Pdf Or Fill Online Tobacco Products Tax Payment Coupon 2013 Templateroller